Group Investing

This is when a group of individuals or entities pool their capital and collectively invest in a particular asset, project, or venture. This approach allows participants to share the risks and potential rewards of the investment. Regardless if you’re investing as a group (group investing) or investing by yourself (solo investing), it’s important to understand the similarities, differences, advantages, and disadvantages with each.

Group Investing

Lower Entry Costs

Diversification

Access to Knowledge & Expertise of Others

Increased Buying Power

Accessibility to Larger Investments

Shared Costs & Expenses

Networking Opportunities

Personal Risk Mitigation

Learning from Real Life Experiences

Solo Investing

Higher Entry Costs or Down Payments

Less Diversification

Full Control Over Investment

Quicker Decision Making

Sole Profits &/or Sole Losses

Resource Constraints

Time-Consuming

Bear Full Risks &/or Full Rewards

Learning from Real Life Experiences

General Overview of Buying an Investment Property

Note: This flowchart provides a general overview of the process, and each step may involve more specific tasks and considerations.

As a solo investor, you take on the full responsibility for every step of the process. Even if you hire people to handle certain tasks, you are still ultimately responsible for the overall success of the investment. While this is one way to achieve your financial goals, it is certainly not the only.

The Power Pool Fund takes the Group Investing approach. We leverage members unique insights, talents, expertise, and resources to invest and achieve potentially exponentially greater results than what we may be able to do individually.

“If you want to go fast, go alone; if you want to go far, go together”

– African Proverb

Commercial Syndications

This is a partnership where multiple investors contribute their capital & expertise to collectively invest in larger & potentially more profitable real estate assets. These assets can include commercial properties like apartment complexes, shopping centers, medical office buildings, and more. The typical minimum investment is anywhere from $50,000 - $100,000. While there are many benefits to investing in these types of assets, it’s important to understand both the advantages and drawbacks of investing in commercial syndications.

Syndication Investing Pros

Real Estate Ownership

Passive Income

Access to Larger Deals

No Landlording Headaches

Higher Potential Returns

Tax Benefits & Advantages

Professional Expertise

Limited Liability

Hands-Off Investments

Syndication Investing Cons

Higher Investment Minimums (Typically $50k-$100k min)

Accreditation Status

Mid to Long Term Commitment

Illiquid Investments

Limited Control

Potential for Capital Calls

Sponsor Related Risks

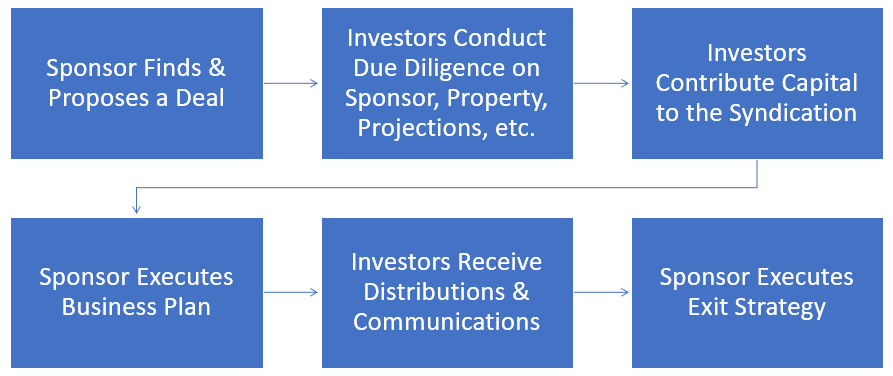

General Overview of Investing in a Syndication

Note: This flowchart provides a general overview of the process, and each step may involve more specific tasks and considerations.

Investing in commercial syndications is a truly passive way to put your money to work for you and take advantage of all the benefits that real estate investing has to offer. The bulk of your efforts is in the vetting & due diligence process to decide if you want in on the opportunity.

With the Power Pool Fund, we perform this process together and then each member decides if they want to participate in the offering. For those that do, we collectively pool our funds and invest for passive returns.

- There Is Power In Pooling Our Funds